To save money from your salary every month is hard, especially when you don’t know where and how to start! When it comes to achieving financial independence, the most difficult step is to begin saving money.

This step-by-step advice to save money from your salary every month will assist you in developing a simple and realistic savings strategy.

In this article, we’ll teach you how much to save every month from your salary, how to set short-term and long-term goals, and where to find an additional source of income. without further ado, let’s begin with;

How much to save from your salary every month?

Your income is the most essential aspect in determining how much to save because your income limits you to some level. When it comes to saving money from your monthly earnings, the amount you save should take priority over the amount you make.

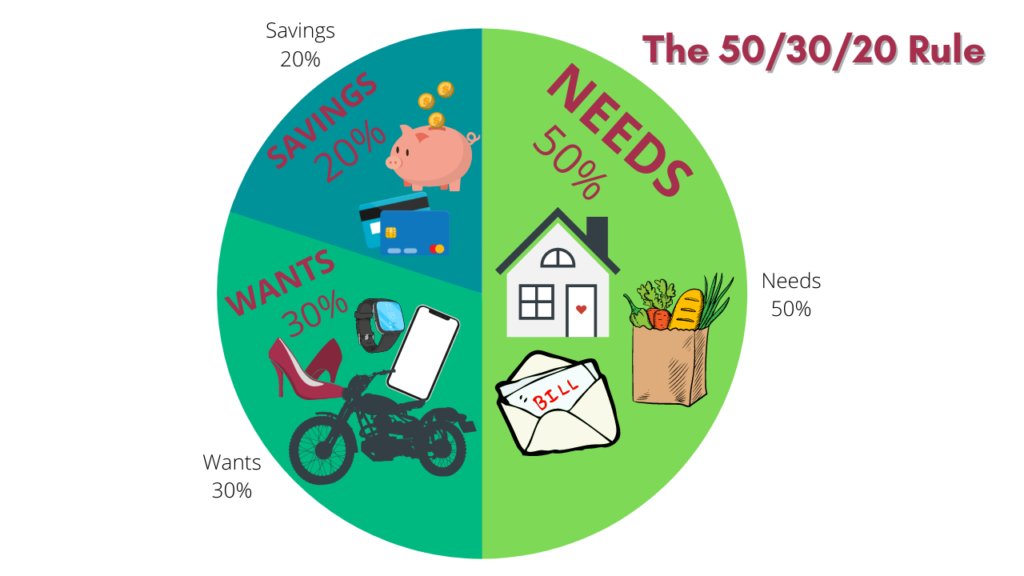

This means that you should save 20% of your monthly earnings or every salary. This formula suggests allocating 50% of your monthly income to basic costs, 30% to lifestyle spending, and the remaining 20% to savings.

Follow these money-saving tips ideas to come up with a new strategy to save money from your salary every month.

The 50/30/20 principle

50 percent for living expenditures, 30 percent for lifestyle expenses, and 20 percent for savings is a good rule of thumb to aim for with your monthly salary. This so-called “50/30/20 budget rule” is popularized by Senator Elizabeth Warren in her book, All Your Worth: The Ultimate Lifetime Money Plan.

How to save money from salary every month(infographic)

The 50/30/20 rules key takeaways:

- Living or Needs Expenses(50%) – These are the “Needs” of your monthly spending for utilities (electric, water, phone, subscription), housing (rent), transportation, groceries, and repairs and maintenance.

- Lifestyle or Wants expenses(30%) – Lifestyle expenses, often known as “Wants,” are costs that help you live more comfortably. They’re the items you buy for enjoyment or leisure. You could live without them, but having them makes your life better. Entertainment, vacations, branded apparel, gym memberships, and coffee shop drinks are all instances of wants.

- Savings(20%) – These are your monthly savings goals, however, you can adjust the 50/30/20 rule to boost your monthly savings from your salary.

Make a spending plan

If you’ve been having trouble saving so far, now is the time to look at your budget to see where you might be able to save some money. The budget will assist you in avoiding overspending, allowing you to save more money.

One of your largest financial expenses, for example, could be food. If you eat out frequently, you might want to seek cost-cutting strategies. Try organizing your week’s meals around sales and shopping using a list that you’ll stick to. To reduce food waste, you can also use coupons and cashback applications, as well as establish a weekly meal. You can maintain a healthy diet while working on a tighter budget.

Find ways to cut your spending

It may be time to cut your spending so that you can save the money you want if your expenses are higher. Identifying what is not important, such as entertainment and eating out, can be eliminated. Look for ways to save money on your fixed monthly fees, such as your TV and phone. by that, it will help you big to save money from your salary every month.

Here are some ideas for cutting your everyday expenses:

- Prepare your own food or pack your lunch and eat at home.

- Cancel any subscriptions or memberships that you not using, especially if they are auto-renew.

- Avoid impulse buying; If you’re tempted to buy anything unnecessary, put it off for a few days. Then after that ask yourself if you still really need to purchase the item.

Set saving goals

Setting a goal is one of the most effective strategies to save money from your salary. Begin by considering what you want to save for—perhaps you’re planning a vacation, getting married, or saving money for your retirement. Try to identify how much money you would like to save and how long it will take to save it.

To give you an example of saving goals:

Short-term goal(1-2 years)

- Capital for own business start-ups

- Vacation

- Downpayment for a car

Long-term goal(3-5 years)

- Retirement

- Buying a house

- Childs Education

Save your salary expenses or bonuses

Sometimes it’s not easy to fight the temptation whenever you receive a salary increase or bonus to reward yourself. Earnings increase, spending rises too! Avoid the temptation to spend that money, instead, put the extra money directly into your savings account.

Say No to debt

Avoid getting into debt, if you have one start paying your debt. Keep in mind that your goal and priority is to save money. If you don’t have a strong reason, don’t take on new debt.

Find ways to earn extra cash

If you can find a way to look for an additional source of income, do it! These days there are a lot of ways to make another source of income all you have to do is search in google. In this way, you can save more and will make your finances a little more secure if ever you lose your regular 9-5 job.

Here are some ideas for extra income;

- Youtube

- Blogging

- Affiliate marketing

- Sell Online

- Create your own products

- Video editing

- Graphic design

- Web design

- Online teaching

- Freelancing

Whatever knowledge or skills you have, try to figure out how you can help others to lessen or solved their problems with your skills. There is unlimited opportunity out there and all you have to do is to reach an audience online.

Related Articles:

- 11 Best Online Jobs in Qatar to Make Extra Money While on a Full-time Job

- 15 Best Profitable Online BUSINESS IDEAS

Key takeaways

You’ve now got the idea reading the 7 easy ways to save money from salary every month, you can start implementing it into your daily life to start building and growing your savings.

It’s good to start by the 50/30/20 rules and look if you can tweak it on what will be comfortable to you on your monthly budgeting.

Always have a budget plan to avoid spending on non-essentials and identify how you can reduce your expenses in order to save more for your short and long-term goals.

Add to your savings once you got an increase in salary or bonuses and do not get into a debt trap. Last but not least is to find ways to have an additional source of income.

That’s it! I hope this helps you to start and achieve your financial goals on how to save money from your monthly salary.

if you are in Qatar and planning to send money to your home country, Check out The best money exchange in Qatar. does this article helpful? Share it with your friends on social media.